Life Insurance Quotes from American National Life | ANICO

Founded in 1905, American National Insurance Company (ANICO) provides an assortment of financial solutions consisting of life insurance, annuities, accident and health insurance, and a variety of pension plan products. The company also offers a variety of property and casualty products for the commercial business industry.

This well-known insurance company offers its products in all 50 states through career agents and independents. ANICO utilizes its subsidiary companies to market insurance and financial services throughout the United States. The company is now based in Galveston, Texas and is powered by more than 3,000 employees in its Texas offices, Missouri offices, and New York offices. The company currently boasts an “A-Excellent” rating from A.M. Best Rating Services.

ANICO’s Life Products

Understanding that life insurance provides financial solutions for a variety of needs, ANICO provides a broad range of products to satisfy U.S. consumers.

Here are some of American National Insurance Company policy offerings:

Signature Term – This term product is fully underwritten and as such, can deliver the lowest rates possible. Available policy terms are 10, 15, 20, and 30-year terms. The eligible issue ages for Signature Term are based upon the requested term of the applicant. The product offers various riders at an additional charge so that policyholders can broaden their coverage and add living benefits to the policy. Policyholders have the option of converting to a permanent policy up to the policy’s expiration date without having to provide insurability.

Freedom Term – ANICI’s Freedom Term Policy is no exam life insurance with available policy terms of 10, 20,, and 30-year terms. The eligible issue ages are 18 to 64-years-old. The insurer offers quick approval in most cases and provides a 30 day free-look period when the insured can cancel the policy for a full refund. Although the Freedom Term product is a no exam insurance policy, ANICO still provides extremely competitive rates.

Legacy Whole Life – This whole life insurance policy is a guaranteed issue product with no medical underwriting. Legacy Whole Life is available in coverage amounts of up to $25,000 and is being offered to applicants age 50 through 80. The Legacy product is an outstanding solution for applicants shopping for final expense or burial insurance. Similar to other guaranteed issue policies, there is a two-year waiting period for death due to natural causes.

ValueGuard Whole Life – The ValueGuard Whole Life product is a no medical exam policy that provides permanent coverage with various guarantees. The policy will remain in force for the lifetime of the insured as long as required premiums are paid. The company cannot cancel the policy for any reason other than non-payment. The periodic premium cannot be changed by the insurer because of illness or age and the policy accumulates cash value that can be accessed through policy loans. Face amounts are offered up to $150,000 for qualified applicants.

Signature Whole Life – Signature Whole Life is a fully underwritten participating whole life insurance policy that is available to applicants age 0 to 80. Death benefits are available from $10,000 to $1 million+. Signature Whole Life provides a guaranteed death benefit, guaranteed level premium, and cash value that earns a fixed interest rate that can be accessed by the policy owner for any reason. The dividends that depend on the financial results of the insurer can be taken as cash, premium reduction, accumulation, or paid-up additions to the face amount.

Executive Universal Life – The Executive UL product is flexible universal life insurance that comes with a three percent guaranteed interest rate. This policy is available in face amounts of $25,000 to one million and above. Eligible issue ages are 0 to 70-years old. ANICO currently offers six additional riders that can be used to broaden the coverage and add additional living benefits to the policy. Although the policy states a minimum interest rate, they have been continuously paying about four percent because of the company’s performance in the markets.

Indexed Universal Life (IUL) – ANICO’s IUL product is a flexible universal life policy that provides fixed and indexed crediting options. Policies are available for persons 0 to 85 with face amounts from $25,000 to one million and more. The IUL policy is targeted at men and women who require an aggressive insurance policy that can accumulate higher cash values. The IUL policy is available with seven additional riders for an additional premium.

Underwriting Guidelines for Marijuana Users

American National will accept individuals who use marijuana on an infrequent basis although their published underwriting guide does not define what “infrequent” use amounts to.

They will assign a standard rating to qualified marijuana users which is typically more than half the rate charged for smokers.

If you are concerned about what drugs your insurance company will look for, check out our post about the drug tests life insurance companies use.

Actual Rates for Acceptable Marijuana Usage

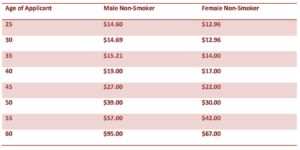

This chart indicates actual life insurance quotes for a male and female non-smoker for a $100,000 20-year Term Insurance policy.