Which Drug Test do Life Insurance Companies Use?

If you are looking for the most affordable rates on Life Insurance, you’ll need to apply with a life insurer who will fully underwrite your application. When an insurer is allowed to fully underwrite the applicant, they will get a crystal clear picture of the risk they are accepting and therefore offer rates that adequately protect the company and typically, these rates are more affordable.

What does the Medical Exam Consist Of?

Typically, the life insurance medical exam is not like a full checkup that is provided by a physician. The life insurance exam is a brief exam that supports or opposes the physical information you provided on the application. The exam generally includes the follow:

- A verbal questionnaire

- Weight and height measurement

- Blood pressure and pulse measurement

- Blood withdrawal

- Urine specimen

For most applicants, the life insurance medical exam can be conducted in the applicant’s home or place of work, without the need to visit a health practitioner or medical facility. The company conducting the exam for the insurer will usually make arrangement according to the needs of the applicant.

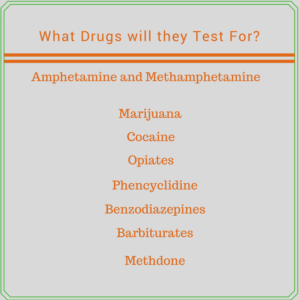

What Drugs will they Test For?

Since most life insurers order a full drug panel, you can expect them to test for some or all of the following drugs:

Besides the drugs listed above, your test will also reveal Hepatitis C and HIV or Aids if present.

Will They test my Blood or my Urine or Both?

In most cases, the insurance company you are applying to will test both. Some of what they are looking for shows up in your blood and some of what they are looking for will show up in your urine. The urine test is more likely to reveal drugs in your system, especially if you have taken something recently.

Blood tests, on the other hand, can reveal many health issues that you have now or are developing. For example, Hepatitis C is a disease that affects the liver but will not typically present symptoms for years or even decades. Many people who have been diagnosed with Hepatitis C found out because of a routine blood test for a life insurance policy. Other serious medical conditions that may be revealed in a drug test are:

- Cardiovascular Diseases – A blood test can reveal if there are dangerous levels of cholesterol and lipid profiles which will likely result in heart disease or stroke. These two issues alone are among the top three causes of death in the U.S.

- Blood Sugar – When high blood sugar is revealed, this is a solid indication of the presence of diabetes. Diabetes generally leads to various complications affecting multiple organs and is diagnosed in any age group, including children.

- Cancer – The PSA (prostate-specific antigen) test is commonly used to screen for prostate cancer in men. Having PSA levels above 4ng/ml is an indicator of increased risk of prostate cancer.

- Liver or Kidney Disorders – If a blood test indicates elevated liver enzymes in your blood, such as SGPT and SGOT, it’s generally an indication of liver damage. If the test reveals elevated BUN (blood urea nitrogen) and creatine, this generally signals kidney insufficiency.

Urine tests are generally used to reveal drug use. In many cases, a drug can show up soon after it is taken and in some cases it can be detected up to 40 days later. The most common drugs that the urine test will reveal are alcohol, amphetamines, barbiturates, benzodiazepines, marijuana, cocaine, codeine, morphine, heroin, methamphetamine, PCP, and nicotine. If any of these drugs are revealed in your drug screen, make sure that you have a legitimate reason and a prescription for taking them.

What if I test Positive for Drugs in My System?

As long as you stated in the application that you are using nicotine or marijuana, or have been prescribed  any of the other legal substances listed, you’ll not have a problem. If, however, you did not disclose your use of any of the drugs found in your drug test, your application could be declined for misrepresentation and omissions of drug use on the application.

any of the other legal substances listed, you’ll not have a problem. If, however, you did not disclose your use of any of the drugs found in your drug test, your application could be declined for misrepresentation and omissions of drug use on the application.

Rather than lie or omit information on the application, you would be better off applying to a company that does not require a medical exam or drug testing. There are many companies that offer no-exam life insurance and in most cases, their rates are considered affordable.

Can a Life Insurer force Me to Have a Drug Test?

The short answer is no. However, the insurer can certainly decline to accept an application from you without the underwriting information they require. If you want the lowest possible rate on your life insurance policy, then a fully-underwritten policy is the best way to go. You can always elect to go with a no-exam insurance policy, however, your rates are likely to be higher because you present a higher risk to the insurer. One of the most sincere concerns we find from applicants is whether the insurer can share your drug test results with your employer or the authorities.

The Law Dictionary has much to say about insurance exams and drug tests…

It’s important to note that you won’t be held criminally liable for failing your insurance company’s drug test. Known as HIPAA, the Health Insurance Portability and Accountability Act prevents insurers from reporting any information about your behavioral choices to the legal authorities. Read the full article…

Which Companies Don’t Require a Medical Exam

There are many life insurers who offer a no-exam life insurance product and there are many who offer a “guaranteed issue” policy if you prefer no medical underwriting whatsoever.

American Amicable, rated “A” by A.M. Best, offers its Term Made Simple policy for individuals seeking life insurance without the hassle of a medical exam. They offer very competitive and affordable rates and will provide the same popular riders that fully underwritten policies provide. Although there are medical questions on the application, the company does not require a medical exam and blood and urine specimens.

American National Life Insurance Company is another company that should be considered when your preference is no-exam life insurance. American National’s Freedom Term product is affordably priced, available in face amounts up to $250,000, and can offer approvals in about 15 minutes.

Assurity Life Insurance enjoys an “A” rating from A.M Best and has been providing valuable life insurance policies to the public for over 123 years. Assurity’s NonMed

Term 350 product is available to individuals between the ages of 18 and 65 with face amounts of up to $350,000. The NonMed Term 350 product is considered a simple issue product resulting in quick approvals and fast policy issuance.

North American’s LifeVue simplified Issue product is a term product that includes health and lifestyle questions but does not require the support of a medical exam or blood and urine tests. The product is considered to be one of the fastest online life insurance policies available.

Transamerica Life Insurance Company was founded in 1928 and has become one of the premier insurers in the marketplace. The company offers very affordable no exam term insurance for up to $249,999 that can include a critical illness rider, chronic illness rider, and disability rider making it one of the few no-exam term products with living benefits.

Which Companies offer Guaranteed Issue Life Insurance?

Guaranteed Issue life insurance is a great solution for people who do not wish to undergo a medical exam or answer medical questions. By issuing a policy with a two or three-year waiting period, the insurer is willing to accept a risk without medical underwriting. If the insured dies from natural causes during the waiting period, most companies will return any premiums paid in plus a small percentage to the beneficiary. If death is the result of an accident, the policy will pay the full benefit from day one.

We have found over time that the most competitive insurers that offer Guaranteed Issue Life Insurance are:

- AIG

- Gerber Life Insurance Company

- LifeShield

How Much Higher is No Exam Life Insurance?

Many people prefer to purchase no-exam life insurance because they may be nervous about the drug test, they feel it’s an invasion of their privacy, or they are simply in a hurry to get their insurance policy in place. Certainly, this is a personal decision, but it’s important that you understand how much more you will be charged by the insurance company.

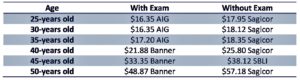

This chart shows the difference between the rates for a fully-underwritten term insurance policy versus a no-exam term policy.

These rates are for a $250,000 20-year term policy for a healthy male non-smoker:

Although there appears to be a minimal difference in the insurance rates between fully underwritten life insurance and no-exam life insurance, you need to extend your costs over the policy term to get an accurate picture of how much more you will pay. Let’s look closer at a 45-year old male:

With Exam: $33.35 per month over 20 years = $8,004

Without Exam: $38.12 per month over 20 years = $9,148.80

The Bottom Line

The bottom line is that MarijuanaLifeInsurance360 can accommodate your needs no matter what your situation is. If you want the lowest insurance rates possible and you are okay having a medical exam and blood/urine test, we have many highly-rated insurance companies you can shop with.

If, however, for whatever reason you prefer not to undergo the insurance exam or drug test, we have many highly-rated insurers that offer no-exam life insurance at very competitive rates.

Even if your health condition disqualifies you from fully-underwritten or no-exam life insurance, we can offer you several companies that offer guaranteed issue life insurance where your medical history is not taken into consideration, In fact, there are no health questions on the application.

7 Comments

Marijuana Smoker and Getting Approved for Life Insurance | Marijuana Life Insurance360

[…] you’ve found the answer to your questions about marijuana and life insurance. Even though the life insurance marketplace continues to evolve on this matter, your search should […]

Life Insurance for Medical Marijuana Users | Marijuana Life Insurance360

[…] and answer all of the medical questions and in most cases, the insurer will require an insurance medical exam that includes blood and urine analysis. This way the insurer is able to get as much information as possible about your health condition […]

Myths about Marijuana and Life Insurance | Marijuana Life Insurance360

[…] Some of us who work in the industry make an attempt to educate our clients and prospective clients, but in almost every case, we need to “unlearn” them and put out the fires that are generally caused by myths. Here we will attempt to correct the record about marijuana and life insurance. […]

MetLife Term Life Insurance for Marijuana Users | MarijuanaLifeInsurance

[…] As you can plainly see, MetLife has high ratings with every third-party rating agency. If you’re searching for a reliable and financially stable company, MetLife is an excellent choice. These ratings can provide peace of mind, knowing that you’re buying life insurance from a reputable organization that will be there when you need them most. It is very important to know what drugs life insurance companies test for. […]

Life Insurance Quotes for Marijuana Users from American General

[…] American General is an insurer that is long on term insurance selections and affordable life insurance quotes. The company offers traditional term products with policy terms ranging from 10 to 25 years and offers a plethora of riders that enables the applicant to broaden their policy coverage and access living benefits. The Select-a-Term products are much more than a death benefit and include two important benefits as part of their core life insurance coverage. You should also note that American General may test for marijuana when applying for life insurance. […]

Life Insurance Quotes for Marijuana Users from Prudential

[…] If you are concerned about what drugs your insurance company will look for, check out our post about the drug tests life insurance companies use. Most companies are now testing for drugs to be considered for life insurance. […]

Life Insurance Quotes from Transamerica for Marijuana Users

[…] are concerned about what drugs your insurance company will look for, check out our post about the drug tests life insurance companies […]