Life Insurance Quotes from Transamerica for Marijuana Users

As part of our series on “marijuana friendly” life insurance companies, we are pleased to discuss Transamerica Life Insurance Company. Like the other companies in this series, Transamerica does take a somewhat liberal approach to life insurance underwriting when it concerns marijuana use. Read on to learn about life insurance quotes from Transamerica.

An Interesting Beginning

A little over a hundred years ago, Amadeo Giannini, founded the Bank of Italy in a remodeled saloon in San Francisco. His mission was to make financial services to available to everyone in the community, especially working class folks. As he began building his list of financial clients, the earthquake and fire in 1906 destroyed the bank building and so Giannini set up a temporary bank on the waterfront and continued his business by offering unsecured loans so residents in the area could rebuild.

temporary bank on the waterfront and continued his business by offering unsecured loans so residents in the area could rebuild.

About twenty years later, in 1928. Mr. Giannini merged his bank with Bank of America and then shortly afterward acquired Occidental Life Insurance Company through the newly formed Transamerica Corporation. Then, in 1956, the bank and the life insurance division separated with the life insurance division retaining the Transamerica name. Less than twenty years later, in 1972, Transamerica claimed its position in the San Francisco skyline with the iconic pyramid-shaped building.

Solid Financial Strength

While Transamerica flourished offering financial services in North and South America, the company set up five separate insurance and financial services companies to service this large geographical area. All of the Transamerica companies enjoy extremely high ratings from the four top financial rating services:

Company |

AM BEST |

MOODY’S |

FITCH |

S&P |

| Transamerica Life Insurance Company | A+ | A1 | A+ | AA- |

| Transamerica Financial Life Insurance Company | A+ | A+ | A1 | AA- |

| Transamerica Premier Life Insurance Company | A+ | A+ | A1 | AA- |

| Transamerica Advisors Life Insurance Company | A+ | A+ | AA- | |

| Transamerica Life Ltd. (Bermuda) | AA- |

Transamerica Term Life Products for Marijuana Users

Transamerica Life Insurance Company offers two types of term life solutions. Both plans provide choices of terms for 10, 15, 20, 25 and 30 years. Insurance coverage ranges from $25,000 up to $1,000,000 per policy. The majority of applicants must submit to an insurance medical exam. However, applicants under a specific age and looking for a certain coverage amount will likely be approved for coverage without having to undergo a medical exam. These underwriting rules will change from time to time, so please call your insurance broker for current underwriting guidelines.

Trendsetter Super Series – This policy provides up to $1,000,000 in coverage with medical exams ordered depending on the age of the applicant and the death benefit requested. Trendsetter Super Series policies include a conversion feature which allows the policyholder to convert their term coverage to permanent coverage (universal life) at the end of the policy period without proof of insurability (non-medical).

Trendsetter LB – The LB in Trendsetter LB stands for “living benefits” which are included in the policy. The Trendsetter LB term policy includes an accelerated death benefit which pays the policyholder an advance on the death benefit if they are diagnosed with a qualified chronic, critical, or terminal illness.

Underwriting Guidelines for Marijuana Use

Current underwriting guidelines for individuals who use marijuana are as follows:

- Using marijuana twelve or fewer times per year – Standard Non-Tobacco

- Using marijuana thirteen or more times per year – Smoker

It’s important to note that any marijuana use should be listed on the insurance application. If marijuana use is NOT listed on the application and then the blood or urine test comes back positive for marijuana, the application will be automatically declined.

If you are concerned about what drugs your insurance company will look for, check out our post about the drug tests life insurance companies use.

It’s also important to note that since the blood/urine test cannot differentiate between smoking, vaping, or ingesting edibles, it doesn’t matter how you consume marijuana – only how often you consume it.

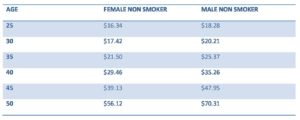

Transamerica Life Insurance Quotes for Marijuana Users

Listed below are actual life insurance quotes for individuals who use marijuana less than thirteen times per year. These life insurance quotes from Transamerica are based on the following assumptions:

- $250,000 Death benefit

- 20 year-term policy

- No additional riders

- Non-smoker

- No serious medical conditions