Life Insurance Quotes for Marijuana Users from American General

American General Life Insurance is among the leading life insurers and financial services firms in the U.S. The company anchors the U.S. life insurance operations of American International Group, under the AIG Life and Retirement umbrella. While currently serving over 13 million policyholders, American General offers clients a wide array of products to help establish and build their nest eggs, including fixed and deferred annuities. The American General Life insurance product selection includes individual and institutional policies. Other products include accident and supplemental health insurance, income protection, and retirement planning programs. Here, we’ll discuss American General’s life insurance quotes for marijuana users.

American General’s parent company, AIG, streamlined its operating structure in 2012 by combining six financial services companies that formerly consisted of the American General Life Companies group — American General Life Insurance of Delaware, American General Assurance, American General Life and Accident Insurance, SunAmerica Annuity and Life Assurance, SunAmerica Life Insurance, and Western National Life Insurance — into American General Life Insurance. One of the member companies, United States Life Insurance of New York, survived the realigning and functions as the underwriter of policies marketed and sold in the state of New York.

Financial Ratings

As one of the outstanding life insurers in the U.S., American General Life Insurance Company maintains extremely high ratings with all of the major insurance company rating services. As of March 2, 2015, A.M., Best Company gives AIG Life Insurance an A, excellent rating. Standard and Poor’s gives AIG Life Insurance an “A+” rating. Either way, you look at it, American General Life Insurance is on a solid financial footing, and that should be an important part of the prospective client’s decision process.

American General’s Term Insurance Products

American General is an insurer that is long on term insurance selections and affordable life insurance quotes. The company offers traditional term products with policy terms ranging from 10 to 25 years and offers a plethora of riders that enables the applicant to broaden their policy coverage and access living benefits. The Select-a-Term products are much more than a death benefit and include two important benefits as part of their core life insurance coverage. You should also note that American General may test for marijuana when applying for life insurance.

- Exchange Option (conversion privilege) – This critical option allows the policyholder to convert all or part of their term policy to an eligible permanent policy during the conversion period stated in the policy. The policy conversion period currently extends to the earlier of the end of the policy period or when the insured turns 75.

- Terminal Illness Benefit – This living benefit is included with no additional premium and will pay a one-time cash benefit of up to 50 percent of the death benefit (capped at $250,000) if the policyholder is diagnosed with a terminal illness that will result in death within 12 months. The diagnosis must be determined by a qualified physician.

- Child Rider (optional) – The Child Rider is available at an additional premium. This rider allows the insured (age 20 – 55) to cover their children (age 15 days to 19 years) for up to $10,000.

- Waiver of Premium (optional) – The waiver of premium rider provides for the insurer to waive the periodic premium payments if the insured becomes totally disabled subject to a six-month waiting period. This rider will expire when the policyholder turns 65 years-old.

Return of Premium Term Insurance

- ROP Select-a-Term 20

This is a 20-year term policy with guaranteed periodic premiums. If the policyholder is still alive when the policy expires, he or she will receive a tax-free lump sum payment for all premiums paid into the policy minus any fees or charges for other riders. If the insured cancels the policy prior to the expiration date, the company may return a portion of the premiums paid in as well.

- ROP Select-a-Term 30

This term policy works the same as the ROP Select-a-Term 20 except it pays a greater refund since the policy was in force longer than the 20-year term policy.

American General’s Underwriting Rules for Marijuana Users

Whether your marijuana use is medicinal or recreational, American General is considered by agents to be among the top “marijuana friendly” life insurers.

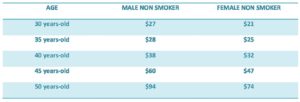

Sample of Term Insurance Quotes from American General

Fortunately, MarijaunaLifeInsurance360.com will allow you to get actual insurance rates when you use the quote engine on their website. Here is a chart of term insurance quotes for your review.

Please see our term insurance rates using the following assumptions:

- $500,000 death benefit

- 20-year Term Insurance Coverage

- No additional riders included

- Preferred rate class

Please note that females typical receive lower life insurance quotes since they tend to live longer than males. If you would like an accurate quote for your actual age, please use our quote engine or contact an insurance professional at (800) 712-8519.